Life Insurance in and around Cleveland

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

When facing the loss of a loved one or your spouse, grief can be overwhelming. Regular day-to-day life halts as you prepare for funeral services arrange for burial, and face life without the one you love.

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Agent Mark Riden, At Your Service

Having the right life insurance coverage can help loss be a bit less debilitating for the people you're closest to and allow time to grieve. It can also help cover bills and other expenses like future savings, utility bills and your funeral costs.

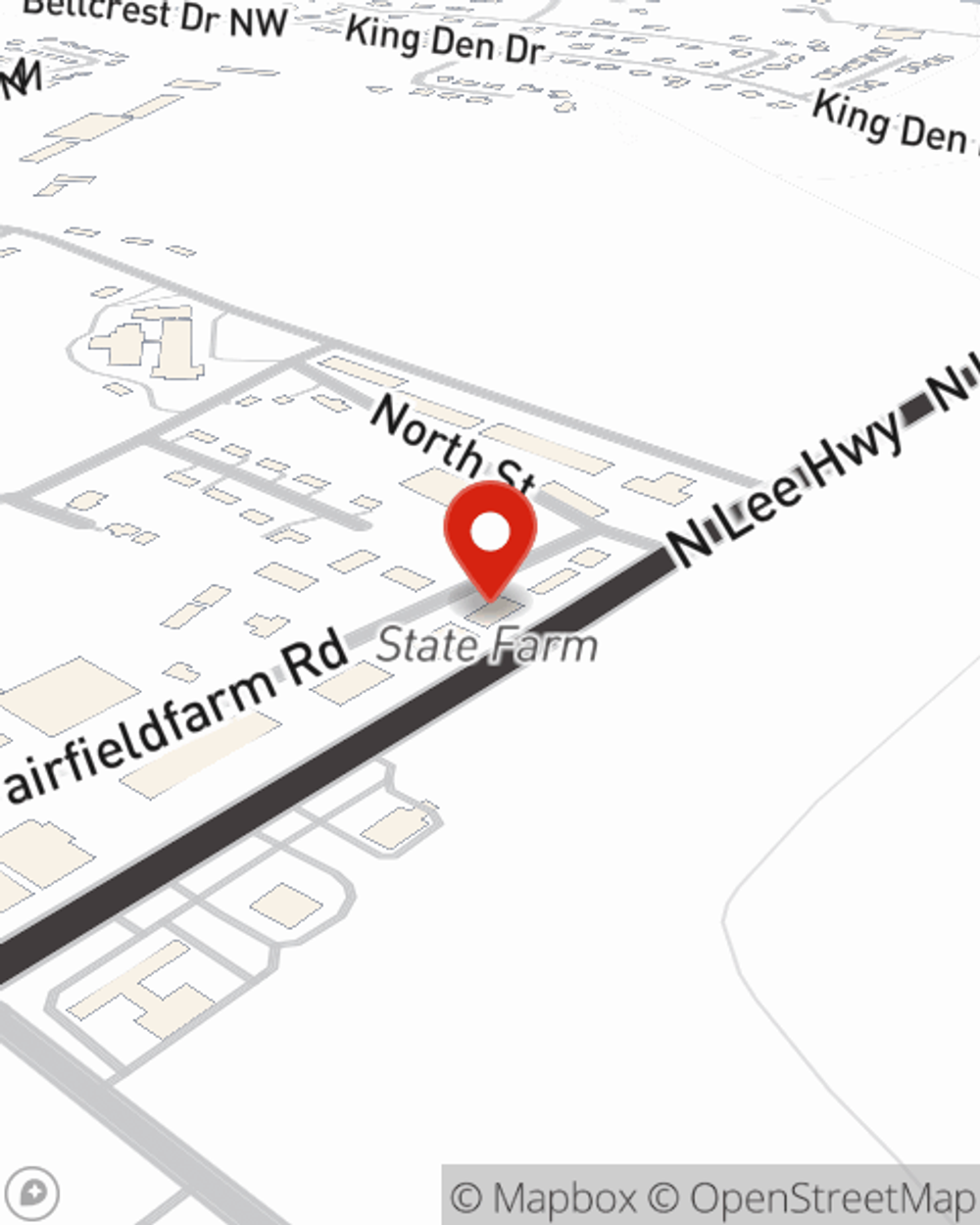

With reliable, compassionate service, State Farm agent Mark Riden can help you make sure you and your loved ones have coverage if something bad does happen. Call or email Mark Riden's office now to learn more about the options that are right for you.

Have More Questions About Life Insurance?

Call Mark at (423) 472-0248 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Simple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.